- Medical

- Fully Insured

- Level-Funded

- Self-Funded

- Medical Captives

- ICHRA

- Individual Medical

- Dental & Vision

- Life & Disability

- Worksite Benefits

- Compliance

- Key Man Policy

- Executive Disability

The only “cost containment” measures you can take on a fully insured plan involve making your offerings worse – diluting your benefits, raising employee premiums, and reducing participation.But even that won’t save you from huge increases.

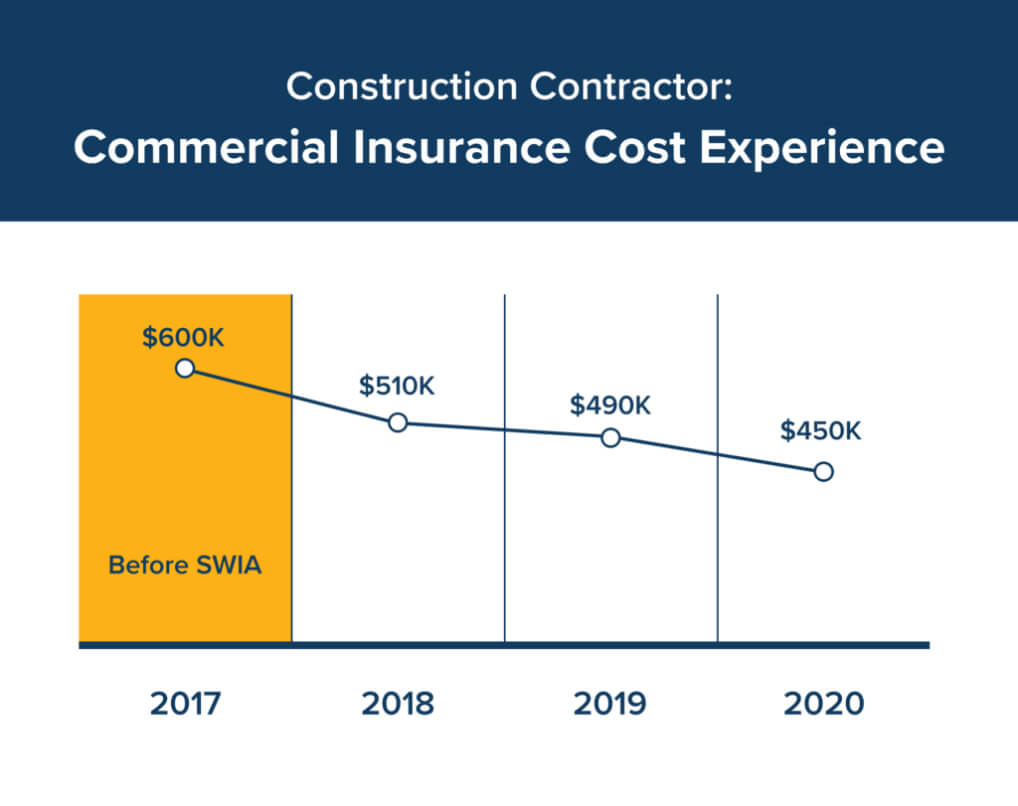

WHO: A large commercial construction contractor

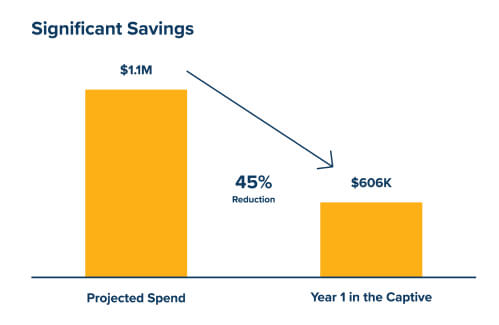

WHAT: They were experiencing steady rate increases on their commercial auto fleet because of claims activity. The national insurer was trying to get double digit rate increases on other lines because of the “hardening property casualty market” even though there was very little claims activity.

RESULTS: In 2018, SWIA decided to move the insurance program to a different insurer while also helping the client strengthen their commercial vehicle safety program. By being proactive, SWIA has saved this client approximately $400K over 3 years.

Since our founding in 1952, we’ve developed partnerships with top-rated insurance companies and inspired confidence in business leaders across the US.