Benefits Case Study: Significant Savings for Technology Company

$494,004 in Savings Year One

The only “cost containment” measures you can take on a fully insured plan involve making your offerings worse – diluting your benefits, raising employee premiums, and reducing participation. But even that won’t save you from huge increases.

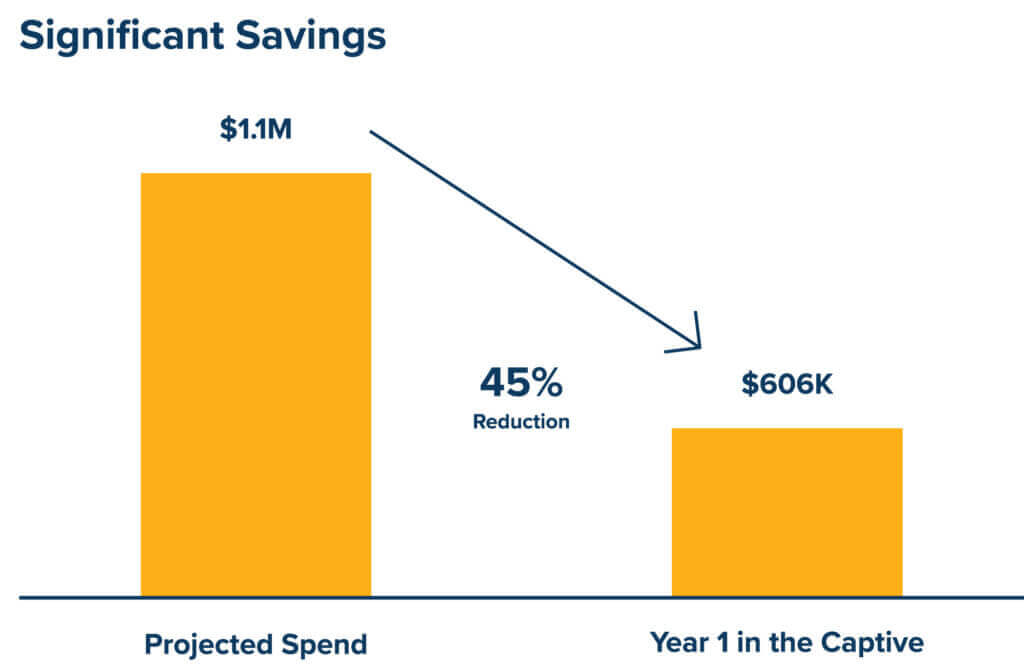

That’s exactly the situation that one midsized technology company faced in 2020. They had tried to work within the old paradigm. That didn’t stop their carrier from hitting them with a 65% renewal, which would have increased their costs to $1.1M. Their situation was becoming untenable.

They needed a partner to shape a strategic vision for the future. They found it in Snellings Walters who moved them into a medical captive.

The Result

Instead of paying $1.1M, they paid $605,996 during their first year in the captive. During that period, their enrollment increased by 18%.

This attests to the real improvements made in their plan structure and a clear reduction in their costs per insured life. This is the advantage of having someone in your corner who knows how to guide you to the right solutions.